Monday, November 10, 2008

New York Driver's License Generator

Wednesday, October 29, 2008

Disconnect Horn On Honda Accord

Science and Technology

13.10.2008

systems who use portable MP3 risking irreversible hearing loss, says EU .

The younger generation, accustomed to the widespread use of portable MP3, are exposed to irreversible hearing loss if they do not limit their use to one hour a day and a volume of no more than 89 decibels, reported today scientists consulted by the European Commission.

The Scientific Committee on New and Emerging Health Risks (CSRSEN its acronym in English), today warned that between 5 and 10 percent of users of portable music devices such as MP3 or iPod, will suffer losses ear for at least five years if volumes continue to be exposed to too high and more than one hour daily.

Five hours a week may be too

According to scientists' need only listen to five hours of music a week to a level over 89 decibels to exceed the noise limits set for the workplace. "

All users who are exposed longer run the risk of irreversible hearing loss over a period of five years, "added the scientists, adding that at least between 2.5 and 10 million users and is among the risk population.

activities such as travel or sports often is linked to the use of these devices, whose sales have soared dramatically in the last four years.

Millions listen MP3

daily

According to the European Commission, between 50 and 100 million people listen to an MP3 on a daily basis. In the EU were sold at between 184 and 246 million portable music readers and between 124 and 165 million MP3 players.

The EU already has a limit of 100 decibels reduces the maximum volume of portable music devices, but the European Commission warned that excessive exposure may, however, damage hearing.

Brussels, which has recently expressed concern over the increasing noise pollution in places of entertainment as a threat to health, today addressed the young, the use of MP3 fans, and recommended use these devices limited in time and volume.

From: http://www.dw-world.de/dw/article/0, 2144,3707528,00. Html

Wednesday, October 15, 2008

Blue Package Gummy Bears

This issue is of global concern and there are many initiatives to improve the current conditions to provide better welfare of our planet.

This issue is of global concern and there are many initiatives to improve the current conditions to provide better welfare of our planet. Here we open a space for comment on two simple elements.

1. How this course relates to this theme?

2. What is being done and what can we do?

Here are a couple of images I downloaded from the web

... I hope your comments .. .

Sunday, October 5, 2008

Thursday, September 25, 2008

Arctic Cat Salvage Yards Ontario

Remember that question I asked in class why the existence of thunder as it is generated so great an uproar? Well, it is still existential doubt, and I stand by the hypothesis of separation of the air (just because it is incredibly cool), but I remember once talking to those "who know the song" mentioned something like

... the rays do not fall off, but that rise from it to the sky ...

Well, it turns out I bought a little camera and therefore did making the whole thing ... would be good to see that saying and see if we reach a conclusion about this, because the rays that out of the ground to the sky, it sounds like a movie. Here taken:

About the phenomenon of thunder, I conducted extensive research (read: I searched for a little while in wikipedia) and I found out that the hypothesis of air separation is not preposterous at all . is that when a beam passes through the air, heating it to do more than 28x10 ^ 3 ° C (36 ° C and is quite here in Killa) and this heat causes the air volume increases very rapidly expanding. But the air is cold at that point (hopefully here as well), and when the now warm air enters the air that I never fail to be cold, it contracts very rapidly, which leads to generate a phenomenon known as shock waves , which produces a sound with a high intensity, which is what makes her scream a lot (and many I must say) during an electrical storm.

What People Are Saying I hope reviews, especially the question of whether the rays that fall or rise to heaven "... and general comments about my first post (do not attack me pleaze U_U)

" L4k ™

Wednesday, September 24, 2008

Bucket Sun Hats Wholesale

here may

Friday, September 5, 2008

What's The Sure Fire Signs Of Herpes

Thursday, September 4, 2008

Best Budget Tripod Fluid Hea

Taken THE HERALDO.COM.CO

Barranquilla, August 31

How to avoid being struck by lightning?

By LEONOR DE LA CRUZ

or.delacruz leon @ elheraldo.com.co

The October 23, 2002 lightning killed him the player Carepa Herman Gaviria of Antioquia com enzaba with their peers, the practice of Deportivo Cali, who was then leader of the soccer tournament mbiano colo.

15 days ago in Barranquilla, Jocelyn Cadavid, a 21 year old almost left paraplegic when receiving electrical urden desc by cell phone wearing under your clothes wet.

Every day falling on the earth one hundred rays per second, the damage they cause is not yet p ueden measure, but according to Colombia loses an estimated 100 million pesos per year from lightning, although not have this statistics on the number of deaths, although in the Serrania de San Lucas, near the municipality of El Bagre, Antioquia, has the highest activity global dial-ray.

Rada, Ph.D. in Physics and professor at the University of North , said: "We have seen that lightning can destroy a person's life, it usually occurs because there is a high energy discharge, which is described by a difference po tential is generated, and the potential difference is created due to the pressures of the particles that make up air masses and other particles that form clouds. Usually it occurs on rainy days. "

explains that the flow of these masses and the charged particles na some way makes the clouds build up electrical charge and try to download through land because land is considered a sink or item that attracts all loads.

"When you create the potential difference between the cloud and the ground are looking to download through the air particles in the middle and that's where you appreciate what is commonly known as lightning, and it's really a shock to thousands of volts that

With regard to cell phones says that it does is create some kind of interference by a party. "When you have some electronic elements in some way such electronic devices are electrically conductive.

Between the possibility of lightning discharge in the head or shoulder, are more likely to be attracted by an electronic device.

Any metallic element mostly may be attractive to that sort of thing and a cell phone has metallic elements and draws electric shock.

Moreover, he says, when it builds a lightning rod for that essentially is the potential difference that travel through the metallic element to the ground and not go the other way.

best during a storm is to turn off mobile phones because their electromagnetic radiation can attract lightning.

Rada says the best place to take refuge in the open during a storm is in a closed car.

"Inside we shut the engine off the radio antenna and disconnect, close the windows and air intakes. While a lightning strike on the vehicle that will be charged only for the exterior while the interior will remain intact, just in case it's still better not come into contact with any metallic body, "he says.

100 Colombia pesos lost each year due to lightning, but there are no statistics on the number of deaths, although in the Serrania de San Lucas, near El Bagre, Antioquia, has the highest global lightning activity.

Recommendations physics

Dr. Thomas Rada recommends:

* Withdraw all high place and refuge in low lying areas prone to flooding or not receive flood water.

* Do not run during a storm and less wet clothes, this is very dangerous. Create turbulence in the air and a convection zone that can attract lightning.

* Get rid of all cash and deposit material over 30 feet away. Rays take advantage of their good conduct.

* Never shelter under a tree or a rock or prominent elements alone. A lone tree by its moisture and vertical field intensity increases electric.

* Stay away from metal objects and items such as, fences, barbed wire, pipes, telephone lines and electrical installations.

* The recommended security position is placed still squatting, crouching as possible. This position will isolate enough because it does not excel much on the ground touching the ground only by shoes with material isolate us more.

Effects of lightning

The internist and neurologist says Jorge Daza Barriga receive a direct hit from lightning is almost synonymous with death, body and mostly to the brain are not prepared for burns it produces, the body suddenly rises by one degree in temperature and especially the brain is severely affected that change occurs immediately in addition to cardiac arrest and often also due to respiratory shock.

Are different effects that can cause people who are in a range of 120 meters of impact:

1. Skin burns.

2. Ruptured eardrum.

3. Lesions in the retina.

4. Fall to the ground by a blast.

5. Fall to the ground by muscular stiffness due to a slight step voltage.

6. Lung lesions and bone lesions.

7. Stress post-traumatic.

8. Death: cardiac arrest.

Respiratory arrest.

9. Brain injury.

If a person is struck by lightning:

* Electric shock does not stay in it, you can meet safely.

* The victim may have burns which was achieved by downloading and also for where it went, and in areas in contact with metal. You may also have damaged the nervous system, have lost sight and hearing and have broken bones.

* In any case request urgent medical assistance and not breathing or heart has stopped trying to revive her.

Thursday, August 14, 2008

Lorena Herrera Desnud Fotos

present a question of the experiment shown here.

Why are the effects on changes in the level of fluid you?

Wednesday, August 13, 2008

Monday, June 30, 2008

How Long Does It Take To Fix Over Crowded

Autonomous learning is a process that allows people to author their own development, choosing paths, strategies, tools and the time it deems appropriate to learn and put into practice what you learned independently. It is an intimate and extremely personal form of human experience, evident (or should be evident) in the transformation and change.

STUDY SKILLS AND LEARNING

Independent Study

The same is used by adults in a very different school, is when it identifies the need for learning and decide how to meet it. This is done without the physical presence the teacher but having some contact with him.

Humans constantly is learning but not under the monitoring of a program of study as the experiences of life teach you but great is good chance to combine learning with programmed learning.

Importantly, the independent student is not isolated but under the guidance of a facilitator, not be controlled or monitored, always having their own control. Independent study in one way or another we have done, when we are going to use a new device and we went to the manual, when looking at someone then try to work, or whether it is a term again independent study.

In traditional education the teacher is one who develops and controls the learning process, where the physical proximity between teachers and students is a way of motivation. In the independent study the student designs its strategy and employs the best way to support the learning process without being required face-to-face.

Autonomous Learning

It everyone learns and develops differently and at different rates than other students, or applied learning experience with reality, it is very important to develop independent learning for life always changing and something new to learn will always be, the student develops the ability or the ability to relate problems to solve, find the necessary information, analyze, generate ideas, draw conclusions and establish the level of achievement of its objectives.

Heathers, skilled in the art distinguishes different types of independence: instrumental and emotional. Instrumental independence is made to perform a task or job without seeking help and if you think you do not need approval from another person to make sure their work, such independence is emotional.

The autonomous learner is emotionally independent, is self-approval and go as the teacher is using a lower degree of autonomy. Arguably the autonomous learning process is for adults, or people capable of self-directed.

Principle of Self-Learning Self-Direction

: the ability of the adult learner take responsibility for planning and directing the course of learning. People who take the initiative in learning have more responsibility to keep learning. On autonomy is easier to stay motivated in the learning process. The cornerstone for self-directed learning is personal responsibility.

To facilitate independent learning what resources are that can be grouped into: Audiovisual Individualized, Institutional, interaction with the teacher. Audiovisual

: self-study modules, educational texts, computers, interactive tutorials for computer, electronic networks, TV and radio. Individualized

: study tours, observation visits, learning projects, personal records, games, creativity, stimulated recall, self-talk. Institutional

libraries, laboratories, practice, classrooms, auditoriums, screening rooms, database, face conferences, teleconferences, audio conferences, discussion groups, email.

interaction with the teacher, mentoring and distance, orientation to learning activities, discussion in study groups, telematic communication, report of activities, evaluations.

Steps to Making

Start the discussion - seeking information - give opinions and information - sort and prepare - to summarize - cocenso test.

Conditions for a group to function as such

Environment - fades cohesions - distributed leadership - the formulation of objectives - flexibility - consensus - compression - ongoing assessment

Red Dots On Forehead Headache

ADJUSTMENTS AND CUT MONTHLY

Adjustment Concept

At the end of the accounting period, the accounts must present actual balance, as these values \u200b\u200bform the basis for preparing financial statements. When account balances are not real need to increase, decrease or corrected by an accounting entry called ajuste.Ajuste seat is the accounting entry required to bring the account balance to its real value.

kinds of settings

ordinariosSon seats Adjustments are made often in the company in a period. This type of settings affect the following accounts: Cash

· Banks

· provisions and bad debts

· Inventory of goods

· Accumulated depreciation

· Expenses Prepaid and deferred charges

· Income received in advance

· Income receivable

· Costs and expenses payable

· provisions for labor obligations

1. Adjustments to the account box, caused by measurement: When verifying the existence of values \u200b\u200bin box, this is to make a tonnage, one must compare its value with the balance books.

2. Adjustments to bank accounts, bank reconciliation caused by: To make this adjustment is necessary to a reconciliation, that is, comparing the balance of the book of Banks of the company with the bank statement balance bancario.Extracto is the document that produced monthly banks to their customers checking or savings account, relating to partial and total movement of the appropriations account, deposits, transfers of checks, withdrawals, debit or credit notes and stocks.

3. Portfolio adjustment provision or estimated doubtful accounts: The value of this portfolio consists of balances due from customers for sale of goods on credit. These balances should appear on the balance sheet at their true worth noting that some debts can not be collected customer death, insolvency, change of address, fires and other acts of God. On the contrary, it is necessary to estimate uncollectible part of the portfolio balance and the Balance Sheet Assets section, make the gross value of customers.

4. Adjustment Inventory of Goods Companies with Perpetual Inventory System: When comparing the total value of the physical inventory of goods in the balance books, can occur when: Physical Inventory greater than the value in the account books of Goods: in this case is a surplus and should be an adjustment for the difference, debiting the account goods not manufactured by the company and crediting the account of cost of sales, for which this occurs, usually for bad records in the books.

5. Adjustment for Depreciation of property, plant and equipment (fixed assets) Depreciation is the expense incurred by an enterprise as tangible fixed assets are worn during life. Can be estimated that the asset is completely consumed during its useful life or residual value can be considered charges for rescue or salvage taking into account the value to be assets at the end of its useful life útil.Vida is the period during which is expected to property, plant and equipment contribute to income generation. For its determination is necessary to consider the legal life regulated by the tax status or technical lifetime fixed taking into account the factory specifications, the obsolescence of technological advances, the wear and tear and time.

6. Deferred Assets Depreciation Adjustment Deferred charges represent materials that the company has purchased for consumption in a future period and paid services in advance, the account recorded in prepaid expenses. Examples: stationery, leases, taxes, interest, advertising, insurance and others. This group includes deferred charges representing the costs and expenses incurred by the company in the early stages of organization, assembly, installation and commissioning, as well as investment costs and project studies.

7. Adjustment for amortization of deferred liabilities, deferred liabilities represent income received in advance. Just as a company can pay in advance, you may also receive money collected in advance for services, rents, commissions and others.

8. Income adjustment cobrarCuando have earned the company an income and has not been charged, must make an adjustment for the value. The value of income and caused it becomes a law firm, which is why debits an asset account called Income Receivable and credits the respective account of income.

9. Adjustment Costs and expenses PagarCuando a company has incurred an expense and is not accounted for, there must be an adjustment for the value. The value of spending and caused entered into in person for the company. Thus the account debits the expense account and credits the account of costs and expenses pagar10. Adjusting for debt laboralesCon to quantify the real value of social benefits by the company, at the end of the accounting period should be seats calculations and adjustments for this item.

1. Settlement of the benefits due each employee, compared to the total value of the settlement of social benefits with the book value

2. It is made by adjusting the value of the difference, crediting or debiting the account for labor obligations, according to increase or decrease the provision, using the expense account item.

Worksheet Worksheet

, also known working state, an accounting document is not mandatory or indispensable, is optional, and also internal in nature, the counter formula prior to the annual closure of the operations and guides you safely make adjusting entries, the income statement and closing the ledger and the financial statements: Situation and Status of results the book of inventories and balances. The state of work is a tabular sheet of 12 columns, which makes the year-end summary of transactions.

adjustment classes.

Depreciation Adjustment

Depreciation is the expense incurred by a company as their tangible fixed assets over the life wear. Can be estimated that the asset is completely consumed lifetime or may be considered residual value charges for rescue or salvage taking into account the value to be assets at the end of its useful life.

useful life is the period during which it is expected that property, plant and equipment contribute to income generation. For its determination is necessary to consider the legal life regulated by the tax status or technical lifetime fixed taking into account the factory specifications, the obsolescence of technological advances, the wear and tear and time.

DEPRECIATION Depreciation is an economic term and accounting referred to the distribution process at the time of lasting value. Additionally it is used as a synonym for depreciation.

is used referring to two areas are nearly the opposite: the depreciation of an asset or cancellation of a liability. In both cases it is a value, usually large, with a duration that extends over several periods or periods, each of which depreciation is calculated, so that value is shared among all the remaining periods .

Deferred Assets Depreciation Adjustment

Deferred charges represent materials that the company has purchased for consumption in a future period and services paid in advance, the account recorded in prepaid expenses. Examples: stationery, leases, taxes, interest, advertising, insurance and others. This group includes deferred charges representing the costs and expenses incurred by the company in the early stages of organization, assembly, installation and commissioning, as well as investment costs and project studies. Provisions

provision means holding the value that the company, according to analysis of the performance of your portfolio, consider that it is not possible to recover, and therefore must be provisioned. Whenever a company makes sales on credit flows the risk that a percentage of customers do not pay their debts to the company becoming a loss, since it will be unable to recover all of it sold on credit. The value of unpaid credit sales from customers is a loss for company will be recognized in profit or exercised, must therefore be carried as an expense. Providing portfolio, after the calculation reduces the value of the portfolio and is recognized as an expense.

WORKSHEET

Concept. The whole process developed from the balance of evidence to the formulation of the financial statements, can be done in a single document called Sheet work. Worksheet, also known working state, is not an accounting document required or indispensable, is optional, and also internal in nature, the counter made prior to the annual closure of operations and serves guide to making safe seats adjustment, income and closing the ledger and the financial statements: Situation and income statement in the book of inventories and balances. The state of work is a tabular sheet of 12 columns, which makes the year-end summary of transactions.

structure. Trial balance. In the first 4 columns record the Trial balance, in the first of these movements are recorded debtor, the second, the creditors in the third

accounts receivable and in the fourth, the creditors.

Adjusting entries. The fifth and sixth columns are intended to record the adjusting entries, the first of them settle the charges and the second fertilizers. Balance Balance

adjusted. The seventh and eighth columns

intended to record the remaining balances in the accounts

after making adjusting entries, in the first of which are recorded in accounts receivable and the second creditors. Seats income. The ninth and tenth columns are used to record entries and loss earnings, also known as

transfers, they are made to transfer the account balances of results to the Profit and Loss in order to know the profit or loss of l year. Balance

prior to balancing. The eleventh and twelfth columns are intended to record the remaining balances of the accounts after making seats or transfer income. Indeed, the balance is taken prior to balance the accounts and balances to make the balance.

There is another way of recording the Worksheet, is called CONCENTRATED WORKSHEET This worksheet form is more practical and simple, it also makes or develops in a tabular sheet of 12 column differs from the previous form is the following: Trial Balance

. After passing the trial balance to the worksheet is not necessary to leave items available on any account. Adjusting entries. The debits and credits to accounts received several adjustments are accumulated separately, and only noted in these columns are the sums of them, preferring instead the number of setting the letter "v", thus the amount Inca corresponds to various adjustments. "

CLOSING SEAT

is that practiced by the end of the operations of an exercise to Achieving a balance sheet. Seat

close: In this seat, credits and debits the balances of all accounts, and ready. This usually does the computer automatically. Beware that when you print the paper, some programs do not print this seat, we do not know why. When you launch the paper for binding, verify that the end is printed in this seat. Eye, with some programs, if we take stock after doing this seat, we will leave all with 0 balance, so if you need a balance sheet to present the annual accounts, the better it before and we print multiple copies.

What is a temporary account? Temporary accounts are personal accounts of limited duration. They have a certain usage period and are used primarily for guest users (attending conferences, courses, exchanges, etc.).

Ultimate Demolition Derby Full

ITEM 1

Section 64. Property, plant and equipment. Property, plant and equipment represent the tangible assets acquired, constructed or under construction, with the intention to employ them permanently, for the production or supply of other goods and services, for rental or for use in the administration the economic entity, not intended for sale in the ordinary course of business and whose useful life exceeds one year.

The historical value of these assets includes all expenses and charges necessary to place them in a position to use, such as engineering, supervision, taxes, interest, monetary correction from UPAC and the difference in exchange rate adjustments.

The historical value of property, plant and equipment, received in exchange, exchange, donation, or payment in kind contribution from the owners, is determined by the value agreed by the parties, duly approved by the authorities when he is the case or, if no price has been determined by appraisal.

The historical value should increase with the additions, improvements and repairs that significantly increase

the quantity or quality of production or the life of the asset.

life means the period during which it is expected that property, plant and equipment, help generate income for its determination is necessary to consider, among other factors, factory specifications, the wear and tear, the action of natural factors, obsolescence by technological advances and changes in demand for the goods or services to contribute to the production or provision.

The contribution of these assets for income generation should be recognized in the income statement through depreciation of their historical value set. When significant, this amount should subtract the residual value determined technically. Depreciation of buildings should be calculated excluding the cost of the respective field.

depreciation should be determined systematically by a recognized technical methods such as straight line, sum of years digits, units of production or work hours. Should be used that method that best meets the basic rule of association.

At the end of the period, the net value of these assets, restated as a result of inflation, must conform to their realizable value or present value or present value, the most appropriate in the circumstances, recording or valuation allowances as circumstances require. May be excepted from this provision those assets whose value set is less than twenty (20) monthly minimum wage.

PROPERTY, PLANT AND EQUIPMENT

tangible assets are held by an enterprise for use in the production or supply of goods and services, for rental to others or for administrative purposes, and is expected to be used for more an economic period.

INTANGIBLE ASSETS

Assets Intangibles are an important part of the market value of companies and organizations in general, his analysis reflects the need of traditional accounting, which does not provide sufficient information regarding the measurement and valuation of these resources.

Intangibles are defined as the set of intangibles, represented in rights, privileges or benefits of competition are valuable because they contribute to increased revenues and profits through its use in the economic entity, these rights are acquired or developed in the normal course of business

Assets Intangible assets are identifiable non-cash and has no physical appearance, is used in the production or supply of goods and services. FIXED ASSETS

tangible fixed assets are classified into three groups: a.

- The Equipment and Machinery. What are machines, buildings, furniture and fixtures, vehicles, assets subject to depreciation because they are life-limited assets.

b. - Natural Resources: Which are subject to termination of the appeal or that are in depletion. C.

- Land: assets are not subject to depreciation or depletion.

Regulation for the Preparation of Financial Information (CONASEV) suggests the use de diversas cuentas para el controldel activo fijo. De acuerdo con este esquema, los activos fijos pueden ser clasificados en: terrenos; edificios y otras construcciones; maquinaria y equipo; unidades de transporte; muebles y enseres; equipos diversos; unidades de reemplazo; unidades por recibir; trabajos en curso.

Adicionalmente a estas cuentas es posible incluir otras específicas para el negocio, como por ejemplo, Inmovilizaciones Agropecuarias (para empresas agrícolas o pecuarias), Reservas Mineras (por el costo de la concesión de las empresas mineras), Inmovilizaciones Forestales (para empresas del sector maderero).

En nuestro medio, las normas tributarias no permiten la contabilización de los recursos naturales as is the case of mining and oil stocks, on the grounds that the soil and subsoil belong to the State, grant a license for exploitation. Depreciation

Depreciation is defined as the process of assigning costs the cost of an asset in the period which is estimated to be used. Often the concept of depreciation

brings confusion and need to be very clear:

1. Depreciation is not a valuation process by which expenditure is allocated to the cost of the asset in accordance with autovalúos made at the end of each period. Depreciation is an allocation the cost of the asset to expenditure in accordance with its original cost.

2. A fully depreciated asset only means you have reached the end of its useful life, ie not recorded more depreciation for the asset. This does not mean that the asset is disposed of or no longer used, in most cases, companies continue to use fully depreciated assets.

3. Depreciation does not mean that business aside cash to replace assets when they become fully depreciated. Depreciation is simply part of the cost of the asset that is sent to costs and no effective means.

4. Depreciation does not involve cash flows but does affect the cash a business that is a deductible expense for tax purposes. Therefore, the depreciation affects the level of profits and taxes. At a higher level of depreciation, profits are lower and taxes are also lower.

Property, plant and equipment

Property, plant and equipment represents all the tangible assets acquired, constructed or under construction, with the intention to employ them permanently, for the production or supply of other goods and services, for rental, or for use in administration not intended for sale and whose useful life exceeds utilización.El year historical value of these assets includes all expenses and charges necessary to place them in a position to use, such as engineering, supervision, tax, monetary correction all those capable of changing the final value of the property. You must also add the value of the improvements, additions and repairs to increase the life or quality of production.

A ssets exhaustible

These assets represent the resources owned by the company. Their number decreases According to the period of their historical value explotación.El is formed by the purchase price, plus all expenses included in the exploration and all items that increase their value. Faced with income generation must be recognized by their "exhaustion" in the reserves estimated to be taken by the studies in terms for payback.

Intangible assets Intangible assets are

resources obtained by an economic entity, lacking material nature, give a right against third parties, which provides a benefit in future periods. These include patents trademarks, franchises, rights Copyright and the goods delivered in trust mercantil.El historical value of these assets is determined by all the expenditures to be made to produce, acquire or train. They are subject to exposure to inflation. At the end of the period should be recognized loss contingencies, adjusting or accelerating depreciation.

ITEM 2

1. System Settings

a. Annual adjustment: is recorded in books at the end of the year, on 31 December. The adjustment value is obtained by applying the PAAG accumulated annual or monthly PAAG. B.

Set Monthly register books at the end of each month. The adjustment value is obtained by applying the monthly PAAG.

2. Indexes Used to Adjust

a. PAAG: PAAG means, the adjustment rate of the tax year, which is equivalent to the percentage change in consumer price index (CPI) for middle income produced by DANE.

· annual PAAG: The rate of adjustment between the first taxable year (1) December previous year and the thirty (30) November respective year.

· accruing monthly PAAG: The PAAG recorded between the first day of the month in which he made the last economic fact day of the month immediately preceding the date on which the adjustment is being calculated.

· PAAG Monthly: Percentage of setting month, which is equivalent to the percentage change in CPI for income recorded in the month preceding the month subject to adjustment made by DANE.

a. Exchange Rate: The values \u200b\u200brepresented in foreign currency as foreign exchange, securities, rights, deposits, investments, debtors, suppliers, should be adjusted based on the exchange rate of the respective currency, the date of closing. The exchange rate used will be the representative of the market established by the Banking Superintendency.

b. Quote of the UVR: The values \u200b\u200bin UPAC is adjusted based on final value of the month or the respective year. C.

Pact Reset: When the titles, rights and liabilities or investments have a pact of adjustment must be adjusted by the value of agreed percentage. ITEM 3

Amortizac ion

The amount of accumulated depreciation by the economic entity on the basis of inflation-adjusted cost of property, plant and equipment tangibles, such as plantations agriculture and forestry, roads and livestock. Depreciation should be based on life is necessary to consider the wear and tear and the action of natural factors.

The value of property, plant and equipment that have a limited shelf life, should be used as a measure of the expiration of these, through the systematic recording of amortization over its useful life or the period during which such income-generating assets.

Therefore, you should observe the following:

• The inflation-adjusted cost basis for depreciation of property.

• The depreciation should be determined by tax rates set in accordance with technical studies through which can establish an appropriate relationship between expired costs of goods and revenue.

·

· Changes in the estimated life span, should be recognized by changing the rate of depreciation on a prospective basis in accordance with the new estimate.

Accumulated amortization should be adjusted for inflation, according to legal norms.

Property, plant and equipment. Property, plant and equipment represent the tangible assets acquired, constructed or under construction, with the intention to employ them permanently, for the production or supply of other goods and services, lease, or for use in managing the economic entity, not intended for sale in the ordinary course of business and whose useful life exceeds one year.

The historical value of these assets includes all expenses and charges necessary to place them in a position to use, such as engineering, supervision, taxes, interest, monetary correction from UPAC and the difference in exchange rate adjustments.

The historical value of property, plant and equipment, received in exchange, exchange, donation, or payment in kind contribution from the owners, is determined by the value agreed by the parties, duly approved by the authorities as the case may be, or where no price has been determined by appraisal.

The historical value should increase with the additions, improvements and repairs that significantly increase the quantity or quality of production or the life of the asset.

life means the period during which it is expected that property, plant and equipment, help generate income for its determination is necessary to consider, among other factors, factory specifications, the wear and tear, the action of natural factors, obsolescence by technological advances and changes in demand for the goods or services to contribute to the production or provision.

The contribution of these assets for income generation should be recognized in the income statement through depreciation of their historical value set. When significant, this amount should subtract the residual value determined technically. Depreciation of buildings should be calculated excluding the cost of the respective field.

depreciation should be determined systematically by a recognized technical methods such as straight line, sum of years digits, units of production or work hours. Should be used that method that best meets the basic rule association.

At the end of the period, the net value of these assets, restated as a result of inflation must be adjusted to net realizable value or present value or present value, the most appropriate in the circumstances, supplies or recording valuations to be the case. May be excepted from this provision those assets whose value set is less than twenty (20) monthly minimum wage.

The actual realizable value or present in these assets should be determined at the end of the period in which they were acquired or formed and at least every three years by appraisals performed by individuals, linked workplace or outside the economic entity, or legal persons of proven professional competence, moral integrity, experience and independence. Provided there are no factors indicating that it would be inappropriate.

Why Does My Dog Crawl

PORTFOLIO

knowledge of what is held, its importance and organization are factors that the accounting clerk and special assistant portfolio must be mastered, the same applies to operations that deal with credit and collections, and most importantly the postings.

CREDIT AND COLLECTION PROCESS SOURCES OF CREDIT INFORMATION

Empire State Study states

Specialized Agencies

Trade References Bank References

Personal Interview Report

credits CREDIT APPLICATION

q To grant a loan must be taken into account

· Study credit credit

· Destination

· Creditworthiness of the debtor and co-signer on loans

• Report

· Guarantees Granted

· Deadline

ACCOUNTS PORTFOLIO COMPRISING

portfolio management of a company involves having clear knowledge about the various accounts that comprise and management to be applied to each of them.

represent accounts and notes by commercial customers

Non-commercial accounts in the portfolio of the company are placed in group 13 of the PUC, these accounts are of liabilities, the rights acquired by credit operations and / or entity other loans granted. WARRANTIES

All credit must have a guarantee that is in payment security. Real

: You will be awarded on the basis of the applicant's goods.

Personal: You will be granted in consideration of economic and moral conditions of the applicant.

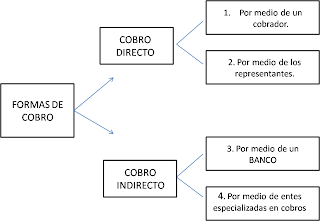

COLLECTION: A collection of resources and processes to ensure timely payment, depending on conditions, within a reasonable time.

PURPOSE: The purpose of the collection is to the money that is owed to the company on account of goods delivered, services rendered and loans made to employees or others.

FORMS OF PAYMENT AND PROVISION MOROSA

PORTFOLIO PORTFOLIO PORTFOLIO

MOROSA: When a debt is not paid within the agreed period is considered past due. It is considered delinquent when they have exhausted the remedies for recovery and there impact on the non-payment. The minimum days past due is charged from the due date and the date of payment of the debt due.

default interest: They are generated by the non-payment of an obligation is fulfilled after the due date.

PROVISION OF HARD FOR DEBT COLLECTION When we PROVISION means synonymous with protection, ie a value that is assigned on the basis of a percentage determined by the law which protects the debts that are considered difficult to recover. Calculating and accounting for the PROVISION OF PORTFOLIO is an essential task in all companies that have a credit sales and therefore the auxiliary and portfolio should be able to carry it out.

maturity analysis refers to the study that makes each customer with respect to credit sales made by the company

· FROM 0 TO 90 DAYS = NO DUE

· FROM 91 TO 180 DAYS = OVERDUE

· FROM 181 TO 360 DAYS = OVERDUE

· MORE THAN 360 DAYS = OVERDUE

The percentage allocated to the estimated provision for doubtful accounts ranging from 5% to 15 % of sales volume in the pipeline, due as follows: a.

Between 91 and 180 days overdue

b. 5% Between 181 and 360 days past due 10%

c. More than a year overdue 15%

INDIVIDUAL PORTFOLIO METHOD

When no individual provision is taken up to 33% for debts that have more than one year overdue.

The company must To analyze the portfolio and returned to the ACCOUNT RECOVERY DIFFICULT accounts that have not been canceled on the date they have exhausted all resources for debt collection policies and the company will proceed with the order for punishment (taking account accounting)

The company can sell their goods to cash or credit, as does the second form the buyer can offer a facility for getting by paying an initial fee and fees monthly or periodic financial interest, the accounts that are used for installment sales are

· Customers

· Inventory of goods

· Deferred income on installment sales

· Usefulness of exercise on installment sales

The penalty for retailers that do not apply this rate is 10 times the minimum wage.

FORMULA FOR MAKING THE BOARD OF FINANCE

i (1 + i) th

=______________

Factor (1 + i) - th

i = nominal interest rate

monthly meetings = number of periods in which funding is divided

1 = Constant

F = Factor by which to multiply the capital to calculate the monthly

To financial interest to know that it is up to each of the periods in which extends the term of the quotas, you should investigate the current rate and apply the formula to find each of the factors