PORTFOLIO

is the set of acquired rights in the development of all operations performed by a company.

knowledge of what is held, its importance and organization are factors that the accounting clerk and special assistant portfolio must be mastered, the same applies to operations that deal with credit and collections, and most importantly the postings.

CREDIT AND COLLECTION PROCESS SOURCES OF CREDIT INFORMATION

Empire State Study states

Specialized Agencies

knowledge of what is held, its importance and organization are factors that the accounting clerk and special assistant portfolio must be mastered, the same applies to operations that deal with credit and collections, and most importantly the postings.

CREDIT AND COLLECTION PROCESS SOURCES OF CREDIT INFORMATION

Empire State Study states

Specialized Agencies

Trade References Bank References

Personal Interview Report

credits CREDIT APPLICATION

q To grant a loan must be taken into account

· Study credit credit

· Destination

· Creditworthiness of the debtor and co-signer on loans

• Report

· Guarantees Granted

· Deadline

ACCOUNTS PORTFOLIO COMPRISING

portfolio management of a company involves having clear knowledge about the various accounts that comprise and management to be applied to each of them.

represent accounts and notes by commercial customers

CLASSIFICATION OF ACCOUNTS ACCOUNTS

I NCLUDES all operations that do not represent the normal activity of the company

Non-commercial accounts in the portfolio of the company are placed in group 13 of the PUC, these accounts are of liabilities, the rights acquired by credit operations and / or entity other loans granted. WARRANTIES

All credit must have a guarantee that is in payment security. Real

: You will be awarded on the basis of the applicant's goods.

Personal: You will be granted in consideration of economic and moral conditions of the applicant.

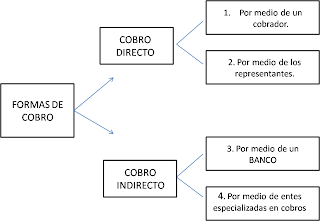

COLLECTION: A collection of resources and processes to ensure timely payment, depending on conditions, within a reasonable time.

PURPOSE: The purpose of the collection is to the money that is owed to the company on account of goods delivered, services rendered and loans made to employees or others.

FORMS OF PAYMENT AND PROVISION MOROSA

PORTFOLIO PORTFOLIO PORTFOLIO

MOROSA: When a debt is not paid within the agreed period is considered past due. It is considered delinquent when they have exhausted the remedies for recovery and there impact on the non-payment. The minimum days past due is charged from the due date and the date of payment of the debt due.

default interest: They are generated by the non-payment of an obligation is fulfilled after the due date.

PROVISION OF HARD FOR DEBT COLLECTION When we PROVISION means synonymous with protection, ie a value that is assigned on the basis of a percentage determined by the law which protects the debts that are considered difficult to recover. Calculating and accounting for the PROVISION OF PORTFOLIO is an essential task in all companies that have a credit sales and therefore the auxiliary and portfolio should be able to carry it out.

maturity analysis refers to the study that makes each customer with respect to credit sales made by the company

Non-commercial accounts in the portfolio of the company are placed in group 13 of the PUC, these accounts are of liabilities, the rights acquired by credit operations and / or entity other loans granted. WARRANTIES

All credit must have a guarantee that is in payment security. Real

: You will be awarded on the basis of the applicant's goods.

Personal: You will be granted in consideration of economic and moral conditions of the applicant.

COLLECTION: A collection of resources and processes to ensure timely payment, depending on conditions, within a reasonable time.

PURPOSE: The purpose of the collection is to the money that is owed to the company on account of goods delivered, services rendered and loans made to employees or others.

FORMS OF PAYMENT AND PROVISION MOROSA

PORTFOLIO PORTFOLIO PORTFOLIO

MOROSA: When a debt is not paid within the agreed period is considered past due. It is considered delinquent when they have exhausted the remedies for recovery and there impact on the non-payment. The minimum days past due is charged from the due date and the date of payment of the debt due.

default interest: They are generated by the non-payment of an obligation is fulfilled after the due date.

PROVISION OF HARD FOR DEBT COLLECTION When we PROVISION means synonymous with protection, ie a value that is assigned on the basis of a percentage determined by the law which protects the debts that are considered difficult to recover. Calculating and accounting for the PROVISION OF PORTFOLIO is an essential task in all companies that have a credit sales and therefore the auxiliary and portfolio should be able to carry it out.

maturity analysis refers to the study that makes each customer with respect to credit sales made by the company

AGE OF PORTFOLIO

· FROM 0 TO 90 DAYS = NO DUE

· FROM 91 TO 180 DAYS = OVERDUE

· FROM 181 TO 360 DAYS = OVERDUE

· MORE THAN 360 DAYS = OVERDUE

· FROM 0 TO 90 DAYS = NO DUE

· FROM 91 TO 180 DAYS = OVERDUE

· FROM 181 TO 360 DAYS = OVERDUE

· MORE THAN 360 DAYS = OVERDUE

GENERAL METHOD

The percentage allocated to the estimated provision for doubtful accounts ranging from 5% to 15 % of sales volume in the pipeline, due as follows: a.

Between 91 and 180 days overdue

b. 5% Between 181 and 360 days past due 10%

c. More than a year overdue 15%

INDIVIDUAL PORTFOLIO METHOD

When no individual provision is taken up to 33% for debts that have more than one year overdue.

The percentage allocated to the estimated provision for doubtful accounts ranging from 5% to 15 % of sales volume in the pipeline, due as follows: a.

Between 91 and 180 days overdue

b. 5% Between 181 and 360 days past due 10%

c. More than a year overdue 15%

INDIVIDUAL PORTFOLIO METHOD

When no individual provision is taken up to 33% for debts that have more than one year overdue.

PUNISHMENT AND PORTFOLIO RECOVERY

The company must To analyze the portfolio and returned to the ACCOUNT RECOVERY DIFFICULT accounts that have not been canceled on the date they have exhausted all resources for debt collection policies and the company will proceed with the order for punishment (taking account accounting)

The company must To analyze the portfolio and returned to the ACCOUNT RECOVERY DIFFICULT accounts that have not been canceled on the date they have exhausted all resources for debt collection policies and the company will proceed with the order for punishment (taking account accounting)

INSTALLMENT SALES

The company can sell their goods to cash or credit, as does the second form the buyer can offer a facility for getting by paying an initial fee and fees monthly or periodic financial interest, the accounts that are used for installment sales are

· Customers

· Inventory of goods

· Deferred income on installment sales

· Usefulness of exercise on installment sales

The company can sell their goods to cash or credit, as does the second form the buyer can offer a facility for getting by paying an initial fee and fees monthly or periodic financial interest, the accounts that are used for installment sales are

· Customers

· Inventory of goods

· Deferred income on installment sales

· Usefulness of exercise on installment sales

SALES CREDIT TO FINANCE

The penalty for retailers that do not apply this rate is 10 times the minimum wage.

FORMULA FOR MAKING THE BOARD OF FINANCE

i (1 + i) th

=______________

Factor (1 + i) - th

i = nominal interest rate

monthly meetings = number of periods in which funding is divided

1 = Constant

F = Factor by which to multiply the capital to calculate the monthly

The penalty for retailers that do not apply this rate is 10 times the minimum wage.

FORMULA FOR MAKING THE BOARD OF FINANCE

i (1 + i) th

=______________

Factor (1 + i) - th

i = nominal interest rate

monthly meetings = number of periods in which funding is divided

1 = Constant

F = Factor by which to multiply the capital to calculate the monthly

VALUE = AMOUNT OF FUNDING - CAPITAL

To financial interest to know that it is up to each of the periods in which extends the term of the quotas, you should investigate the current rate and apply the formula to find each of the factors

To financial interest to know that it is up to each of the periods in which extends the term of the quotas, you should investigate the current rate and apply the formula to find each of the factors

0 comments:

Post a Comment