Independent learning

Autonomous learning is a process that allows people to author their own development, choosing paths, strategies, tools and the time it deems appropriate to learn and put into practice what you learned independently. It is an intimate and extremely personal form of human experience, evident (or should be evident) in the transformation and change.

STUDY SKILLS AND LEARNING

Independent Study

The same is used by adults in a very different school, is when it identifies the need for learning and decide how to meet it. This is done without the physical presence the teacher but having some contact with him.

Humans constantly is learning but not under the monitoring of a program of study as the experiences of life teach you but great is good chance to combine learning with programmed learning.

Importantly, the independent student is not isolated but under the guidance of a facilitator, not be controlled or monitored, always having their own control. Independent study in one way or another we have done, when we are going to use a new device and we went to the manual, when looking at someone then try to work, or whether it is a term again independent study.

In traditional education the teacher is one who develops and controls the learning process, where the physical proximity between teachers and students is a way of motivation. In the independent study the student designs its strategy and employs the best way to support the learning process without being required face-to-face.

Autonomous Learning

It everyone learns and develops differently and at different rates than other students, or applied learning experience with reality, it is very important to develop independent learning for life always changing and something new to learn will always be, the student develops the ability or the ability to relate problems to solve, find the necessary information, analyze, generate ideas, draw conclusions and establish the level of achievement of its objectives.

Heathers, skilled in the art distinguishes different types of independence: instrumental and emotional. Instrumental independence is made to perform a task or job without seeking help and if you think you do not need approval from another person to make sure their work, such independence is emotional.

The autonomous learner is emotionally independent, is self-approval and go as the teacher is using a lower degree of autonomy. Arguably the autonomous learning process is for adults, or people capable of self-directed.

Principle of Self-Learning Self-Direction

: the ability of the adult learner take responsibility for planning and directing the course of learning. People who take the initiative in learning have more responsibility to keep learning. On autonomy is easier to stay motivated in the learning process. The cornerstone for self-directed learning is personal responsibility.

To facilitate independent learning what resources are that can be grouped into: Audiovisual Individualized, Institutional, interaction with the teacher. Audiovisual

: self-study modules, educational texts, computers, interactive tutorials for computer, electronic networks, TV and radio. Individualized

: study tours, observation visits, learning projects, personal records, games, creativity, stimulated recall, self-talk. Institutional

libraries, laboratories, practice, classrooms, auditoriums, screening rooms, database, face conferences, teleconferences, audio conferences, discussion groups, email.

interaction with the teacher, mentoring and distance, orientation to learning activities, discussion in study groups, telematic communication, report of activities, evaluations.

Steps to Making

Start the discussion - seeking information - give opinions and information - sort and prepare - to summarize - cocenso test.

Conditions for a group to function as such

Environment - fades cohesions - distributed leadership - the formulation of objectives - flexibility - consensus - compression - ongoing assessment

Monday, June 30, 2008

Red Dots On Forehead Headache

ADJUSTMENTS AND CUT MONTHLY

Adjustment Concept

At the end of the accounting period, the accounts must present actual balance, as these values \u200b\u200bform the basis for preparing financial statements. When account balances are not real need to increase, decrease or corrected by an accounting entry called ajuste.Ajuste seat is the accounting entry required to bring the account balance to its real value.

kinds of settings

ordinariosSon seats Adjustments are made often in the company in a period. This type of settings affect the following accounts: Cash

· Banks

· provisions and bad debts

· Inventory of goods

· Accumulated depreciation

· Expenses Prepaid and deferred charges

· Income received in advance

· Income receivable

· Costs and expenses payable

· provisions for labor obligations

1. Adjustments to the account box, caused by measurement: When verifying the existence of values \u200b\u200bin box, this is to make a tonnage, one must compare its value with the balance books.

2. Adjustments to bank accounts, bank reconciliation caused by: To make this adjustment is necessary to a reconciliation, that is, comparing the balance of the book of Banks of the company with the bank statement balance bancario.Extracto is the document that produced monthly banks to their customers checking or savings account, relating to partial and total movement of the appropriations account, deposits, transfers of checks, withdrawals, debit or credit notes and stocks.

3. Portfolio adjustment provision or estimated doubtful accounts: The value of this portfolio consists of balances due from customers for sale of goods on credit. These balances should appear on the balance sheet at their true worth noting that some debts can not be collected customer death, insolvency, change of address, fires and other acts of God. On the contrary, it is necessary to estimate uncollectible part of the portfolio balance and the Balance Sheet Assets section, make the gross value of customers.

4. Adjustment Inventory of Goods Companies with Perpetual Inventory System: When comparing the total value of the physical inventory of goods in the balance books, can occur when: Physical Inventory greater than the value in the account books of Goods: in this case is a surplus and should be an adjustment for the difference, debiting the account goods not manufactured by the company and crediting the account of cost of sales, for which this occurs, usually for bad records in the books.

5. Adjustment for Depreciation of property, plant and equipment (fixed assets) Depreciation is the expense incurred by an enterprise as tangible fixed assets are worn during life. Can be estimated that the asset is completely consumed during its useful life or residual value can be considered charges for rescue or salvage taking into account the value to be assets at the end of its useful life útil.Vida is the period during which is expected to property, plant and equipment contribute to income generation. For its determination is necessary to consider the legal life regulated by the tax status or technical lifetime fixed taking into account the factory specifications, the obsolescence of technological advances, the wear and tear and time.

6. Deferred Assets Depreciation Adjustment Deferred charges represent materials that the company has purchased for consumption in a future period and paid services in advance, the account recorded in prepaid expenses. Examples: stationery, leases, taxes, interest, advertising, insurance and others. This group includes deferred charges representing the costs and expenses incurred by the company in the early stages of organization, assembly, installation and commissioning, as well as investment costs and project studies.

7. Adjustment for amortization of deferred liabilities, deferred liabilities represent income received in advance. Just as a company can pay in advance, you may also receive money collected in advance for services, rents, commissions and others.

8. Income adjustment cobrarCuando have earned the company an income and has not been charged, must make an adjustment for the value. The value of income and caused it becomes a law firm, which is why debits an asset account called Income Receivable and credits the respective account of income.

9. Adjustment Costs and expenses PagarCuando a company has incurred an expense and is not accounted for, there must be an adjustment for the value. The value of spending and caused entered into in person for the company. Thus the account debits the expense account and credits the account of costs and expenses pagar10. Adjusting for debt laboralesCon to quantify the real value of social benefits by the company, at the end of the accounting period should be seats calculations and adjustments for this item.

1. Settlement of the benefits due each employee, compared to the total value of the settlement of social benefits with the book value

2. It is made by adjusting the value of the difference, crediting or debiting the account for labor obligations, according to increase or decrease the provision, using the expense account item.

Worksheet Worksheet

, also known working state, an accounting document is not mandatory or indispensable, is optional, and also internal in nature, the counter formula prior to the annual closure of the operations and guides you safely make adjusting entries, the income statement and closing the ledger and the financial statements: Situation and Status of results the book of inventories and balances. The state of work is a tabular sheet of 12 columns, which makes the year-end summary of transactions.

adjustment classes.

Depreciation Adjustment

Depreciation is the expense incurred by a company as their tangible fixed assets over the life wear. Can be estimated that the asset is completely consumed lifetime or may be considered residual value charges for rescue or salvage taking into account the value to be assets at the end of its useful life.

useful life is the period during which it is expected that property, plant and equipment contribute to income generation. For its determination is necessary to consider the legal life regulated by the tax status or technical lifetime fixed taking into account the factory specifications, the obsolescence of technological advances, the wear and tear and time.

DEPRECIATION Depreciation is an economic term and accounting referred to the distribution process at the time of lasting value. Additionally it is used as a synonym for depreciation.

is used referring to two areas are nearly the opposite: the depreciation of an asset or cancellation of a liability. In both cases it is a value, usually large, with a duration that extends over several periods or periods, each of which depreciation is calculated, so that value is shared among all the remaining periods .

Deferred Assets Depreciation Adjustment

Deferred charges represent materials that the company has purchased for consumption in a future period and services paid in advance, the account recorded in prepaid expenses. Examples: stationery, leases, taxes, interest, advertising, insurance and others. This group includes deferred charges representing the costs and expenses incurred by the company in the early stages of organization, assembly, installation and commissioning, as well as investment costs and project studies. Provisions

provision means holding the value that the company, according to analysis of the performance of your portfolio, consider that it is not possible to recover, and therefore must be provisioned. Whenever a company makes sales on credit flows the risk that a percentage of customers do not pay their debts to the company becoming a loss, since it will be unable to recover all of it sold on credit. The value of unpaid credit sales from customers is a loss for company will be recognized in profit or exercised, must therefore be carried as an expense. Providing portfolio, after the calculation reduces the value of the portfolio and is recognized as an expense.

WORKSHEET

Concept. The whole process developed from the balance of evidence to the formulation of the financial statements, can be done in a single document called Sheet work. Worksheet, also known working state, is not an accounting document required or indispensable, is optional, and also internal in nature, the counter made prior to the annual closure of operations and serves guide to making safe seats adjustment, income and closing the ledger and the financial statements: Situation and income statement in the book of inventories and balances. The state of work is a tabular sheet of 12 columns, which makes the year-end summary of transactions.

structure. Trial balance. In the first 4 columns record the Trial balance, in the first of these movements are recorded debtor, the second, the creditors in the third

accounts receivable and in the fourth, the creditors.

Adjusting entries. The fifth and sixth columns are intended to record the adjusting entries, the first of them settle the charges and the second fertilizers. Balance Balance

adjusted. The seventh and eighth columns

intended to record the remaining balances in the accounts

after making adjusting entries, in the first of which are recorded in accounts receivable and the second creditors. Seats income. The ninth and tenth columns are used to record entries and loss earnings, also known as

transfers, they are made to transfer the account balances of results to the Profit and Loss in order to know the profit or loss of l year. Balance

prior to balancing. The eleventh and twelfth columns are intended to record the remaining balances of the accounts after making seats or transfer income. Indeed, the balance is taken prior to balance the accounts and balances to make the balance.

There is another way of recording the Worksheet, is called CONCENTRATED WORKSHEET This worksheet form is more practical and simple, it also makes or develops in a tabular sheet of 12 column differs from the previous form is the following: Trial Balance

. After passing the trial balance to the worksheet is not necessary to leave items available on any account. Adjusting entries. The debits and credits to accounts received several adjustments are accumulated separately, and only noted in these columns are the sums of them, preferring instead the number of setting the letter "v", thus the amount Inca corresponds to various adjustments. "

CLOSING SEAT

is that practiced by the end of the operations of an exercise to Achieving a balance sheet. Seat

close: In this seat, credits and debits the balances of all accounts, and ready. This usually does the computer automatically. Beware that when you print the paper, some programs do not print this seat, we do not know why. When you launch the paper for binding, verify that the end is printed in this seat. Eye, with some programs, if we take stock after doing this seat, we will leave all with 0 balance, so if you need a balance sheet to present the annual accounts, the better it before and we print multiple copies.

What is a temporary account? Temporary accounts are personal accounts of limited duration. They have a certain usage period and are used primarily for guest users (attending conferences, courses, exchanges, etc.).

Ultimate Demolition Derby Full

Settings Property, Plant and Equipment Portfolio

ITEM 1

Section 64. Property, plant and equipment. Property, plant and equipment represent the tangible assets acquired, constructed or under construction, with the intention to employ them permanently, for the production or supply of other goods and services, for rental or for use in the administration the economic entity, not intended for sale in the ordinary course of business and whose useful life exceeds one year.

The historical value of these assets includes all expenses and charges necessary to place them in a position to use, such as engineering, supervision, taxes, interest, monetary correction from UPAC and the difference in exchange rate adjustments.

The historical value of property, plant and equipment, received in exchange, exchange, donation, or payment in kind contribution from the owners, is determined by the value agreed by the parties, duly approved by the authorities when he is the case or, if no price has been determined by appraisal.

The historical value should increase with the additions, improvements and repairs that significantly increase

the quantity or quality of production or the life of the asset.

life means the period during which it is expected that property, plant and equipment, help generate income for its determination is necessary to consider, among other factors, factory specifications, the wear and tear, the action of natural factors, obsolescence by technological advances and changes in demand for the goods or services to contribute to the production or provision.

The contribution of these assets for income generation should be recognized in the income statement through depreciation of their historical value set. When significant, this amount should subtract the residual value determined technically. Depreciation of buildings should be calculated excluding the cost of the respective field.

depreciation should be determined systematically by a recognized technical methods such as straight line, sum of years digits, units of production or work hours. Should be used that method that best meets the basic rule of association.

At the end of the period, the net value of these assets, restated as a result of inflation, must conform to their realizable value or present value or present value, the most appropriate in the circumstances, recording or valuation allowances as circumstances require. May be excepted from this provision those assets whose value set is less than twenty (20) monthly minimum wage.

PROPERTY, PLANT AND EQUIPMENT

tangible assets are held by an enterprise for use in the production or supply of goods and services, for rental to others or for administrative purposes, and is expected to be used for more an economic period.

INTANGIBLE ASSETS

Assets Intangibles are an important part of the market value of companies and organizations in general, his analysis reflects the need of traditional accounting, which does not provide sufficient information regarding the measurement and valuation of these resources.

Intangibles are defined as the set of intangibles, represented in rights, privileges or benefits of competition are valuable because they contribute to increased revenues and profits through its use in the economic entity, these rights are acquired or developed in the normal course of business

Assets Intangible assets are identifiable non-cash and has no physical appearance, is used in the production or supply of goods and services. FIXED ASSETS

tangible fixed assets are classified into three groups: a.

- The Equipment and Machinery. What are machines, buildings, furniture and fixtures, vehicles, assets subject to depreciation because they are life-limited assets.

b. - Natural Resources: Which are subject to termination of the appeal or that are in depletion. C.

- Land: assets are not subject to depreciation or depletion.

Regulation for the Preparation of Financial Information (CONASEV) suggests the use de diversas cuentas para el controldel activo fijo. De acuerdo con este esquema, los activos fijos pueden ser clasificados en: terrenos; edificios y otras construcciones; maquinaria y equipo; unidades de transporte; muebles y enseres; equipos diversos; unidades de reemplazo; unidades por recibir; trabajos en curso.

Adicionalmente a estas cuentas es posible incluir otras específicas para el negocio, como por ejemplo, Inmovilizaciones Agropecuarias (para empresas agrícolas o pecuarias), Reservas Mineras (por el costo de la concesión de las empresas mineras), Inmovilizaciones Forestales (para empresas del sector maderero).

En nuestro medio, las normas tributarias no permiten la contabilización de los recursos naturales as is the case of mining and oil stocks, on the grounds that the soil and subsoil belong to the State, grant a license for exploitation. Depreciation

Depreciation is defined as the process of assigning costs the cost of an asset in the period which is estimated to be used. Often the concept of depreciation

brings confusion and need to be very clear:

1. Depreciation is not a valuation process by which expenditure is allocated to the cost of the asset in accordance with autovalúos made at the end of each period. Depreciation is an allocation the cost of the asset to expenditure in accordance with its original cost.

2. A fully depreciated asset only means you have reached the end of its useful life, ie not recorded more depreciation for the asset. This does not mean that the asset is disposed of or no longer used, in most cases, companies continue to use fully depreciated assets.

3. Depreciation does not mean that business aside cash to replace assets when they become fully depreciated. Depreciation is simply part of the cost of the asset that is sent to costs and no effective means.

4. Depreciation does not involve cash flows but does affect the cash a business that is a deductible expense for tax purposes. Therefore, the depreciation affects the level of profits and taxes. At a higher level of depreciation, profits are lower and taxes are also lower.

Property, plant and equipment

Property, plant and equipment represents all the tangible assets acquired, constructed or under construction, with the intention to employ them permanently, for the production or supply of other goods and services, for rental, or for use in administration not intended for sale and whose useful life exceeds utilización.El year historical value of these assets includes all expenses and charges necessary to place them in a position to use, such as engineering, supervision, tax, monetary correction all those capable of changing the final value of the property. You must also add the value of the improvements, additions and repairs to increase the life or quality of production.

A ssets exhaustible

These assets represent the resources owned by the company. Their number decreases According to the period of their historical value explotación.El is formed by the purchase price, plus all expenses included in the exploration and all items that increase their value. Faced with income generation must be recognized by their "exhaustion" in the reserves estimated to be taken by the studies in terms for payback.

Intangible assets Intangible assets are

resources obtained by an economic entity, lacking material nature, give a right against third parties, which provides a benefit in future periods. These include patents trademarks, franchises, rights Copyright and the goods delivered in trust mercantil.El historical value of these assets is determined by all the expenditures to be made to produce, acquire or train. They are subject to exposure to inflation. At the end of the period should be recognized loss contingencies, adjusting or accelerating depreciation.

ITEM 2

1. System Settings

a. Annual adjustment: is recorded in books at the end of the year, on 31 December. The adjustment value is obtained by applying the PAAG accumulated annual or monthly PAAG. B.

Set Monthly register books at the end of each month. The adjustment value is obtained by applying the monthly PAAG.

2. Indexes Used to Adjust

a. PAAG: PAAG means, the adjustment rate of the tax year, which is equivalent to the percentage change in consumer price index (CPI) for middle income produced by DANE.

· annual PAAG: The rate of adjustment between the first taxable year (1) December previous year and the thirty (30) November respective year.

· accruing monthly PAAG: The PAAG recorded between the first day of the month in which he made the last economic fact day of the month immediately preceding the date on which the adjustment is being calculated.

· PAAG Monthly: Percentage of setting month, which is equivalent to the percentage change in CPI for income recorded in the month preceding the month subject to adjustment made by DANE.

a. Exchange Rate: The values \u200b\u200brepresented in foreign currency as foreign exchange, securities, rights, deposits, investments, debtors, suppliers, should be adjusted based on the exchange rate of the respective currency, the date of closing. The exchange rate used will be the representative of the market established by the Banking Superintendency.

b. Quote of the UVR: The values \u200b\u200bin UPAC is adjusted based on final value of the month or the respective year. C.

Pact Reset: When the titles, rights and liabilities or investments have a pact of adjustment must be adjusted by the value of agreed percentage. ITEM 3

Amortizac ion

The amount of accumulated depreciation by the economic entity on the basis of inflation-adjusted cost of property, plant and equipment tangibles, such as plantations agriculture and forestry, roads and livestock. Depreciation should be based on life is necessary to consider the wear and tear and the action of natural factors.

The value of property, plant and equipment that have a limited shelf life, should be used as a measure of the expiration of these, through the systematic recording of amortization over its useful life or the period during which such income-generating assets.

Therefore, you should observe the following:

• The inflation-adjusted cost basis for depreciation of property.

• The depreciation should be determined by tax rates set in accordance with technical studies through which can establish an appropriate relationship between expired costs of goods and revenue.

·

· Changes in the estimated life span, should be recognized by changing the rate of depreciation on a prospective basis in accordance with the new estimate.

Accumulated amortization should be adjusted for inflation, according to legal norms.

Property, plant and equipment. Property, plant and equipment represent the tangible assets acquired, constructed or under construction, with the intention to employ them permanently, for the production or supply of other goods and services, lease, or for use in managing the economic entity, not intended for sale in the ordinary course of business and whose useful life exceeds one year.

The historical value of these assets includes all expenses and charges necessary to place them in a position to use, such as engineering, supervision, taxes, interest, monetary correction from UPAC and the difference in exchange rate adjustments.

The historical value of property, plant and equipment, received in exchange, exchange, donation, or payment in kind contribution from the owners, is determined by the value agreed by the parties, duly approved by the authorities as the case may be, or where no price has been determined by appraisal.

The historical value should increase with the additions, improvements and repairs that significantly increase the quantity or quality of production or the life of the asset.

life means the period during which it is expected that property, plant and equipment, help generate income for its determination is necessary to consider, among other factors, factory specifications, the wear and tear, the action of natural factors, obsolescence by technological advances and changes in demand for the goods or services to contribute to the production or provision.

The contribution of these assets for income generation should be recognized in the income statement through depreciation of their historical value set. When significant, this amount should subtract the residual value determined technically. Depreciation of buildings should be calculated excluding the cost of the respective field.

depreciation should be determined systematically by a recognized technical methods such as straight line, sum of years digits, units of production or work hours. Should be used that method that best meets the basic rule association.

At the end of the period, the net value of these assets, restated as a result of inflation must be adjusted to net realizable value or present value or present value, the most appropriate in the circumstances, supplies or recording valuations to be the case. May be excepted from this provision those assets whose value set is less than twenty (20) monthly minimum wage.

The actual realizable value or present in these assets should be determined at the end of the period in which they were acquired or formed and at least every three years by appraisals performed by individuals, linked workplace or outside the economic entity, or legal persons of proven professional competence, moral integrity, experience and independence. Provided there are no factors indicating that it would be inappropriate.

ITEM 1

Section 64. Property, plant and equipment. Property, plant and equipment represent the tangible assets acquired, constructed or under construction, with the intention to employ them permanently, for the production or supply of other goods and services, for rental or for use in the administration the economic entity, not intended for sale in the ordinary course of business and whose useful life exceeds one year.

The historical value of these assets includes all expenses and charges necessary to place them in a position to use, such as engineering, supervision, taxes, interest, monetary correction from UPAC and the difference in exchange rate adjustments.

The historical value of property, plant and equipment, received in exchange, exchange, donation, or payment in kind contribution from the owners, is determined by the value agreed by the parties, duly approved by the authorities when he is the case or, if no price has been determined by appraisal.

The historical value should increase with the additions, improvements and repairs that significantly increase

the quantity or quality of production or the life of the asset.

life means the period during which it is expected that property, plant and equipment, help generate income for its determination is necessary to consider, among other factors, factory specifications, the wear and tear, the action of natural factors, obsolescence by technological advances and changes in demand for the goods or services to contribute to the production or provision.

The contribution of these assets for income generation should be recognized in the income statement through depreciation of their historical value set. When significant, this amount should subtract the residual value determined technically. Depreciation of buildings should be calculated excluding the cost of the respective field.

depreciation should be determined systematically by a recognized technical methods such as straight line, sum of years digits, units of production or work hours. Should be used that method that best meets the basic rule of association.

At the end of the period, the net value of these assets, restated as a result of inflation, must conform to their realizable value or present value or present value, the most appropriate in the circumstances, recording or valuation allowances as circumstances require. May be excepted from this provision those assets whose value set is less than twenty (20) monthly minimum wage.

PROPERTY, PLANT AND EQUIPMENT

tangible assets are held by an enterprise for use in the production or supply of goods and services, for rental to others or for administrative purposes, and is expected to be used for more an economic period.

INTANGIBLE ASSETS

Assets Intangibles are an important part of the market value of companies and organizations in general, his analysis reflects the need of traditional accounting, which does not provide sufficient information regarding the measurement and valuation of these resources.

Intangibles are defined as the set of intangibles, represented in rights, privileges or benefits of competition are valuable because they contribute to increased revenues and profits through its use in the economic entity, these rights are acquired or developed in the normal course of business

Assets Intangible assets are identifiable non-cash and has no physical appearance, is used in the production or supply of goods and services. FIXED ASSETS

tangible fixed assets are classified into three groups: a.

- The Equipment and Machinery. What are machines, buildings, furniture and fixtures, vehicles, assets subject to depreciation because they are life-limited assets.

b. - Natural Resources: Which are subject to termination of the appeal or that are in depletion. C.

- Land: assets are not subject to depreciation or depletion.

Regulation for the Preparation of Financial Information (CONASEV) suggests the use de diversas cuentas para el controldel activo fijo. De acuerdo con este esquema, los activos fijos pueden ser clasificados en: terrenos; edificios y otras construcciones; maquinaria y equipo; unidades de transporte; muebles y enseres; equipos diversos; unidades de reemplazo; unidades por recibir; trabajos en curso.

Adicionalmente a estas cuentas es posible incluir otras específicas para el negocio, como por ejemplo, Inmovilizaciones Agropecuarias (para empresas agrícolas o pecuarias), Reservas Mineras (por el costo de la concesión de las empresas mineras), Inmovilizaciones Forestales (para empresas del sector maderero).

En nuestro medio, las normas tributarias no permiten la contabilización de los recursos naturales as is the case of mining and oil stocks, on the grounds that the soil and subsoil belong to the State, grant a license for exploitation. Depreciation

Depreciation is defined as the process of assigning costs the cost of an asset in the period which is estimated to be used. Often the concept of depreciation

brings confusion and need to be very clear:

1. Depreciation is not a valuation process by which expenditure is allocated to the cost of the asset in accordance with autovalúos made at the end of each period. Depreciation is an allocation the cost of the asset to expenditure in accordance with its original cost.

2. A fully depreciated asset only means you have reached the end of its useful life, ie not recorded more depreciation for the asset. This does not mean that the asset is disposed of or no longer used, in most cases, companies continue to use fully depreciated assets.

3. Depreciation does not mean that business aside cash to replace assets when they become fully depreciated. Depreciation is simply part of the cost of the asset that is sent to costs and no effective means.

4. Depreciation does not involve cash flows but does affect the cash a business that is a deductible expense for tax purposes. Therefore, the depreciation affects the level of profits and taxes. At a higher level of depreciation, profits are lower and taxes are also lower.

Property, plant and equipment

Property, plant and equipment represents all the tangible assets acquired, constructed or under construction, with the intention to employ them permanently, for the production or supply of other goods and services, for rental, or for use in administration not intended for sale and whose useful life exceeds utilización.El year historical value of these assets includes all expenses and charges necessary to place them in a position to use, such as engineering, supervision, tax, monetary correction all those capable of changing the final value of the property. You must also add the value of the improvements, additions and repairs to increase the life or quality of production.

A ssets exhaustible

These assets represent the resources owned by the company. Their number decreases According to the period of their historical value explotación.El is formed by the purchase price, plus all expenses included in the exploration and all items that increase their value. Faced with income generation must be recognized by their "exhaustion" in the reserves estimated to be taken by the studies in terms for payback.

Intangible assets Intangible assets are

resources obtained by an economic entity, lacking material nature, give a right against third parties, which provides a benefit in future periods. These include patents trademarks, franchises, rights Copyright and the goods delivered in trust mercantil.El historical value of these assets is determined by all the expenditures to be made to produce, acquire or train. They are subject to exposure to inflation. At the end of the period should be recognized loss contingencies, adjusting or accelerating depreciation.

ITEM 2

1. System Settings

a. Annual adjustment: is recorded in books at the end of the year, on 31 December. The adjustment value is obtained by applying the PAAG accumulated annual or monthly PAAG. B.

Set Monthly register books at the end of each month. The adjustment value is obtained by applying the monthly PAAG.

2. Indexes Used to Adjust

a. PAAG: PAAG means, the adjustment rate of the tax year, which is equivalent to the percentage change in consumer price index (CPI) for middle income produced by DANE.

· annual PAAG: The rate of adjustment between the first taxable year (1) December previous year and the thirty (30) November respective year.

· accruing monthly PAAG: The PAAG recorded between the first day of the month in which he made the last economic fact day of the month immediately preceding the date on which the adjustment is being calculated.

· PAAG Monthly: Percentage of setting month, which is equivalent to the percentage change in CPI for income recorded in the month preceding the month subject to adjustment made by DANE.

a. Exchange Rate: The values \u200b\u200brepresented in foreign currency as foreign exchange, securities, rights, deposits, investments, debtors, suppliers, should be adjusted based on the exchange rate of the respective currency, the date of closing. The exchange rate used will be the representative of the market established by the Banking Superintendency.

b. Quote of the UVR: The values \u200b\u200bin UPAC is adjusted based on final value of the month or the respective year. C.

Pact Reset: When the titles, rights and liabilities or investments have a pact of adjustment must be adjusted by the value of agreed percentage. ITEM 3

Amortizac ion

The amount of accumulated depreciation by the economic entity on the basis of inflation-adjusted cost of property, plant and equipment tangibles, such as plantations agriculture and forestry, roads and livestock. Depreciation should be based on life is necessary to consider the wear and tear and the action of natural factors.

The value of property, plant and equipment that have a limited shelf life, should be used as a measure of the expiration of these, through the systematic recording of amortization over its useful life or the period during which such income-generating assets.

Therefore, you should observe the following:

• The inflation-adjusted cost basis for depreciation of property.

• The depreciation should be determined by tax rates set in accordance with technical studies through which can establish an appropriate relationship between expired costs of goods and revenue.

·

· Changes in the estimated life span, should be recognized by changing the rate of depreciation on a prospective basis in accordance with the new estimate.

Accumulated amortization should be adjusted for inflation, according to legal norms.

Property, plant and equipment. Property, plant and equipment represent the tangible assets acquired, constructed or under construction, with the intention to employ them permanently, for the production or supply of other goods and services, lease, or for use in managing the economic entity, not intended for sale in the ordinary course of business and whose useful life exceeds one year.

The historical value of these assets includes all expenses and charges necessary to place them in a position to use, such as engineering, supervision, taxes, interest, monetary correction from UPAC and the difference in exchange rate adjustments.

The historical value of property, plant and equipment, received in exchange, exchange, donation, or payment in kind contribution from the owners, is determined by the value agreed by the parties, duly approved by the authorities as the case may be, or where no price has been determined by appraisal.

The historical value should increase with the additions, improvements and repairs that significantly increase the quantity or quality of production or the life of the asset.

life means the period during which it is expected that property, plant and equipment, help generate income for its determination is necessary to consider, among other factors, factory specifications, the wear and tear, the action of natural factors, obsolescence by technological advances and changes in demand for the goods or services to contribute to the production or provision.

The contribution of these assets for income generation should be recognized in the income statement through depreciation of their historical value set. When significant, this amount should subtract the residual value determined technically. Depreciation of buildings should be calculated excluding the cost of the respective field.

depreciation should be determined systematically by a recognized technical methods such as straight line, sum of years digits, units of production or work hours. Should be used that method that best meets the basic rule association.

At the end of the period, the net value of these assets, restated as a result of inflation must be adjusted to net realizable value or present value or present value, the most appropriate in the circumstances, supplies or recording valuations to be the case. May be excepted from this provision those assets whose value set is less than twenty (20) monthly minimum wage.

The actual realizable value or present in these assets should be determined at the end of the period in which they were acquired or formed and at least every three years by appraisals performed by individuals, linked workplace or outside the economic entity, or legal persons of proven professional competence, moral integrity, experience and independence. Provided there are no factors indicating that it would be inappropriate.

Why Does My Dog Crawl

PORTFOLIO

is the set of acquired rights in the development of all operations performed by a company.

knowledge of what is held, its importance and organization are factors that the accounting clerk and special assistant portfolio must be mastered, the same applies to operations that deal with credit and collections, and most importantly the postings.

CREDIT AND COLLECTION PROCESS SOURCES OF CREDIT INFORMATION

Empire State Study states

Specialized Agencies

knowledge of what is held, its importance and organization are factors that the accounting clerk and special assistant portfolio must be mastered, the same applies to operations that deal with credit and collections, and most importantly the postings.

CREDIT AND COLLECTION PROCESS SOURCES OF CREDIT INFORMATION

Empire State Study states

Specialized Agencies

Trade References Bank References

Personal Interview Report

credits CREDIT APPLICATION

q To grant a loan must be taken into account

· Study credit credit

· Destination

· Creditworthiness of the debtor and co-signer on loans

• Report

· Guarantees Granted

· Deadline

ACCOUNTS PORTFOLIO COMPRISING

portfolio management of a company involves having clear knowledge about the various accounts that comprise and management to be applied to each of them.

represent accounts and notes by commercial customers

CLASSIFICATION OF ACCOUNTS ACCOUNTS

I NCLUDES all operations that do not represent the normal activity of the company

Non-commercial accounts in the portfolio of the company are placed in group 13 of the PUC, these accounts are of liabilities, the rights acquired by credit operations and / or entity other loans granted. WARRANTIES

All credit must have a guarantee that is in payment security. Real

: You will be awarded on the basis of the applicant's goods.

Personal: You will be granted in consideration of economic and moral conditions of the applicant.

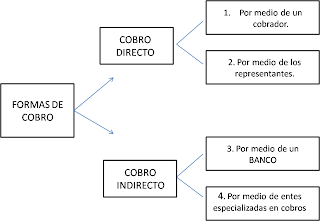

COLLECTION: A collection of resources and processes to ensure timely payment, depending on conditions, within a reasonable time.

PURPOSE: The purpose of the collection is to the money that is owed to the company on account of goods delivered, services rendered and loans made to employees or others.

FORMS OF PAYMENT AND PROVISION MOROSA

PORTFOLIO PORTFOLIO PORTFOLIO

MOROSA: When a debt is not paid within the agreed period is considered past due. It is considered delinquent when they have exhausted the remedies for recovery and there impact on the non-payment. The minimum days past due is charged from the due date and the date of payment of the debt due.

default interest: They are generated by the non-payment of an obligation is fulfilled after the due date.

PROVISION OF HARD FOR DEBT COLLECTION When we PROVISION means synonymous with protection, ie a value that is assigned on the basis of a percentage determined by the law which protects the debts that are considered difficult to recover. Calculating and accounting for the PROVISION OF PORTFOLIO is an essential task in all companies that have a credit sales and therefore the auxiliary and portfolio should be able to carry it out.

maturity analysis refers to the study that makes each customer with respect to credit sales made by the company

Non-commercial accounts in the portfolio of the company are placed in group 13 of the PUC, these accounts are of liabilities, the rights acquired by credit operations and / or entity other loans granted. WARRANTIES

All credit must have a guarantee that is in payment security. Real

: You will be awarded on the basis of the applicant's goods.

Personal: You will be granted in consideration of economic and moral conditions of the applicant.

COLLECTION: A collection of resources and processes to ensure timely payment, depending on conditions, within a reasonable time.

PURPOSE: The purpose of the collection is to the money that is owed to the company on account of goods delivered, services rendered and loans made to employees or others.

FORMS OF PAYMENT AND PROVISION MOROSA

PORTFOLIO PORTFOLIO PORTFOLIO

MOROSA: When a debt is not paid within the agreed period is considered past due. It is considered delinquent when they have exhausted the remedies for recovery and there impact on the non-payment. The minimum days past due is charged from the due date and the date of payment of the debt due.

default interest: They are generated by the non-payment of an obligation is fulfilled after the due date.

PROVISION OF HARD FOR DEBT COLLECTION When we PROVISION means synonymous with protection, ie a value that is assigned on the basis of a percentage determined by the law which protects the debts that are considered difficult to recover. Calculating and accounting for the PROVISION OF PORTFOLIO is an essential task in all companies that have a credit sales and therefore the auxiliary and portfolio should be able to carry it out.

maturity analysis refers to the study that makes each customer with respect to credit sales made by the company

AGE OF PORTFOLIO

· FROM 0 TO 90 DAYS = NO DUE

· FROM 91 TO 180 DAYS = OVERDUE

· FROM 181 TO 360 DAYS = OVERDUE

· MORE THAN 360 DAYS = OVERDUE

· FROM 0 TO 90 DAYS = NO DUE

· FROM 91 TO 180 DAYS = OVERDUE

· FROM 181 TO 360 DAYS = OVERDUE

· MORE THAN 360 DAYS = OVERDUE

GENERAL METHOD

The percentage allocated to the estimated provision for doubtful accounts ranging from 5% to 15 % of sales volume in the pipeline, due as follows: a.

Between 91 and 180 days overdue

b. 5% Between 181 and 360 days past due 10%

c. More than a year overdue 15%

INDIVIDUAL PORTFOLIO METHOD

When no individual provision is taken up to 33% for debts that have more than one year overdue.

The percentage allocated to the estimated provision for doubtful accounts ranging from 5% to 15 % of sales volume in the pipeline, due as follows: a.

Between 91 and 180 days overdue

b. 5% Between 181 and 360 days past due 10%

c. More than a year overdue 15%

INDIVIDUAL PORTFOLIO METHOD

When no individual provision is taken up to 33% for debts that have more than one year overdue.

PUNISHMENT AND PORTFOLIO RECOVERY

The company must To analyze the portfolio and returned to the ACCOUNT RECOVERY DIFFICULT accounts that have not been canceled on the date they have exhausted all resources for debt collection policies and the company will proceed with the order for punishment (taking account accounting)

The company must To analyze the portfolio and returned to the ACCOUNT RECOVERY DIFFICULT accounts that have not been canceled on the date they have exhausted all resources for debt collection policies and the company will proceed with the order for punishment (taking account accounting)

INSTALLMENT SALES

The company can sell their goods to cash or credit, as does the second form the buyer can offer a facility for getting by paying an initial fee and fees monthly or periodic financial interest, the accounts that are used for installment sales are

· Customers

· Inventory of goods

· Deferred income on installment sales

· Usefulness of exercise on installment sales

The company can sell their goods to cash or credit, as does the second form the buyer can offer a facility for getting by paying an initial fee and fees monthly or periodic financial interest, the accounts that are used for installment sales are

· Customers

· Inventory of goods

· Deferred income on installment sales

· Usefulness of exercise on installment sales

SALES CREDIT TO FINANCE

The penalty for retailers that do not apply this rate is 10 times the minimum wage.

FORMULA FOR MAKING THE BOARD OF FINANCE

i (1 + i) th

=______________

Factor (1 + i) - th

i = nominal interest rate

monthly meetings = number of periods in which funding is divided

1 = Constant

F = Factor by which to multiply the capital to calculate the monthly

The penalty for retailers that do not apply this rate is 10 times the minimum wage.

FORMULA FOR MAKING THE BOARD OF FINANCE

i (1 + i) th

=______________

Factor (1 + i) - th

i = nominal interest rate

monthly meetings = number of periods in which funding is divided

1 = Constant

F = Factor by which to multiply the capital to calculate the monthly

VALUE = AMOUNT OF FUNDING - CAPITAL

To financial interest to know that it is up to each of the periods in which extends the term of the quotas, you should investigate the current rate and apply the formula to find each of the factors

To financial interest to know that it is up to each of the periods in which extends the term of the quotas, you should investigate the current rate and apply the formula to find each of the factors

Heart Gold Soul Silverpokemon Sprites

INVENTORIES

DECREE 2649/93.

Section 63. Inventories. Inventories represent tangible property for sale in the ordinary course of business, and those who are in production or are used or consumed in the production of others that will be sold.

The value of inventories, which includes all expenditures and direct and indirect charges necessary to put in a position to use or sale, to be determined using the FIFO (First In, First Out), LIFO (Last In, First Out), the identification specific or weighted average.

To recognize the annual effect of inflation and determine the cost of sales and inventory for the respective year, you must:

1. Adjusting for the annual PAAG the inventory.

2. Adjusting for the accumulated monthly PAAG, inventory purchases made in the year and other factors that are part of the cost, except for those with a particular form adjustment.

on a heading, for the same period, you can not make a double adjustment. This rule should be considered for the transfer of inventory during the production process.

monthly to recognize the effect of inflation, when using the perpetual inventory system, adjust the monthly PAAG owned inventory at the beginning of each month. When using the game system called inventory should also adjust the balances accumulated in the first day of respective month in the accounts of inventory purchases and production costs, when they do not have a particular form of adjustment. The values \u200b\u200bfor the respective operations for the month are not subject to adjustment.

Under either option, the ending inventory and cost of sales should correctly reflect adjustments for inflation, according to the method has been used to determine its value.

At the end of the period should be recognized loss contingencies stated value of inventories by the provisions required to conform to its net realizable value.

Without prejudice to special rules for the preparation of financial statements for interim periods is permissible to determine the cost of inventory and recognition of loss contingencies based on statistical estimates.

Section 63. Inventories. Inventories represent tangible property for sale in the ordinary course of business, and those who are in production or are used or consumed in the production of others that will be sold.

The value of inventories, which includes all expenditures and direct and indirect charges necessary to put in a position to use or sale, to be determined using the FIFO (First In, First Out), LIFO (Last In, First Out), the identification specific or weighted average.

To recognize the annual effect of inflation and determine the cost of sales and inventory for the respective year, you must:

1. Adjusting for the annual PAAG the inventory.

2. Adjusting for the accumulated monthly PAAG, inventory purchases made in the year and other factors that are part of the cost, except for those with a particular form adjustment.

on a heading, for the same period, you can not make a double adjustment. This rule should be considered for the transfer of inventory during the production process.

monthly to recognize the effect of inflation, when using the perpetual inventory system, adjust the monthly PAAG owned inventory at the beginning of each month. When using the game system called inventory should also adjust the balances accumulated in the first day of respective month in the accounts of inventory purchases and production costs, when they do not have a particular form of adjustment. The values \u200b\u200bfor the respective operations for the month are not subject to adjustment.

Under either option, the ending inventory and cost of sales should correctly reflect adjustments for inflation, according to the method has been used to determine its value.

At the end of the period should be recognized loss contingencies stated value of inventories by the provisions required to conform to its net realizable value.

Without prejudice to special rules for the preparation of financial statements for interim periods is permissible to determine the cost of inventory and recognition of loss contingencies based on statistical estimates.

INVENTORY SYSTEM To record and control the inventories, companies adopt appropriate systems to value their stocks of goods in order to determine its possible production and sales volume

understand the concept, characteristics and the fundamentals of the valuation of inventories may be useful for the company, since these are what really set the point of production that can take one period. The financial manager must have the relevant information to enable it to make management decisions that must be given to this area of \u200b\u200borganizational active. PERIODIC INVENTORY SYSTEM

Using this system, traders determine the value of stocks goods by conducting a physical count on a regular basis, which is called the starting or ending inventory as appropriate.

Beginning Inventory: The detailed and thorough inventory of goods that have a business to start up, after doing a physical count. Ending inventory

: The ratio of stocks at the end of an accounting period.

Through this system the company knows the value of the merchandise in stock at any time, without requiring a physical count, because the movements of purchase and sale of goods is recorded directly in the time of the transaction to your cost.

Companies adopting such a system should maintain an auxiliary of goods called "Kardex", which is recorded every item that is bought or sold. Addition and subtraction of all operations in a period results in the final balance of goods.

Comment: The companies that are by law required to file a tax return must use the perpetual inventory system coupling the criterion

goods inventories are all stocks at cost with which the company produces goods and sells its products

finished

METHODS FOR VALUATION OF INVENTORIES

Companies must assess their goods, so their inventory value, calculate the cost, determine the level of utility and production set their level of sales. Currently used methods for valuing these inventories:

1. Assessment by specific identification

in business whose inventory consists of goods the same, but each of them is distinguished from others by their individual characteristics of a number, mark or reference a particular cost, cars are a clear example of this type assessment because these seemingly identical but they differ by color, engine number, number, model etc.

2. Standard cost valuation

This method facilitates the management of auxiliary goods "Kardex" because only in quantities required be homogeneous units:

3. Valuation at cost

Assess inventory cost price means the company relates to the price of goods adquisición.Comentario: If you want to expand their understanding of these concepts through assessment of costing inventories in the channel will find articles and documents that explain in detail the foundations and application, see the file finanzas.Las goods companies must choose the rating system that best suits your needs and allows him to exercise a permanent control of them

METHODS FOR SECURING THE COST

The methods used to determine the cost of goods company is the weighted average, LIFO or FIFO and FIFO or LIFO, then presented their rationale and an example of its application:

1. Weighted average method

This method is to find the average cost of each of the items that are in the final inventory when the units are identical in appearance but not the purchase price, since they were purchased in different times and different prices. To set the value of cost of goods by this method takes the value of merchandise inventory and adding initial procurement period, then divide by the number of units plus the initial inventory purchased during the period.

2. FIFO or FIFO

applied to goods means that stockpiles first enter the inventory are the first to leave it, that means the first to be purchased are the first sold.

3. Or LIFO LIFO

This method is based on the last life in is the first out. This is the last acquired are the first sold. APPLICATION OF THE METHODS

In the following example is intended to explain the application of each of the methods for determining the cost of goods in inventory.

Quantity Unit Cost Total value

Beginning Inventory 10 Units.

$ 10,000 $ 100,000

Shopping

30 pcs.

$ 15,000 $ 450,000 Total

40 pcs.

$ 550,000 Sales

period

35 pcs. Ending inventory

5 pcs.

1.

weighted average total value = $ 550,000 = $ 13,750 Total 40

The average cost per item is $ 13,750

The value of ending inventory = 5 pcs. * $ 13,750 = $ 68,750

The ending inventory is valued at average cost in-stock merchandise.

2. FIFO or FIFO inventory

final value = 5 pcs. * $ 15,000 = $ 75,000

The ending inventory is valued at the cost of the last goods purchased.

3. Or LIFO LIFO inventory

final value = 5 pcs. * $ 10,000 = $ 50,000

The ending inventory is valued at the cost of the first in-stock merchandise.

4. Average final analysis

$ 68,750 $ 75,000

FIFO LIFO

$ 50,000

By analyzing the three methods can draw the conclusion that the lowest value is obtained using the LIFO, the highest in the FIFO and an interim valuation to the average. Inventory incluyeMaterias

raw goods owned by the company found in the cellar; Goods in transit goods on consignment

FEATURES ADVANTAGES DISADVANTAGES

understand the concept, fundamentals of the valuation of inventories may be useful for the company, since these are what really set the point of production that can take one period.

Administrator Financial information must be relevant to enable it to make management decisions that must be given to this area of \u200b\u200borganizational active.

PERIODIC INVENTORY SYSTEM

Using this system, traders determine the value of stocks of goods by conducting a physical count on a regular basis, which is called the starting or ending inventory as appropriate.

. Beginning Inventory: The detailed and thorough inventory of goods that have a business to start up, after doing a physical count.

· Inventory final: The ratio of stocks at the end an accounting period.

Inventories are tangible assets held for sale in the ordinary course of business or to be consumed in the production of goods or services for further marketing.

internal control inventory begins with the establishment of a purchasing department to be managing inventory purchases according to the process compras.Diariamente accumulate large accounts such as revenues, costs and expenses of a can compañía.Se obtain account balances reconciled important, banks, inventories, accounts receivable and accounts pagar.La documentation to support the recorded information can be verified easily and seats eficaz.Los to be counted in the general journal, show the accuracy of daily debits and credits.

accounting for inventories is very important for the accounting of goods, because the sale of inventory is the heart of the business.

The costs of purchases of goods must dirirge to the account entitled: Costs of Shopping. This account has a debit balance and is not in the Balance Sheet. Returns

purchase, refers to the account that is created to reflect all that the company purchased merchandise returns for any reason, although this has reduced the purchase of goods shall be paid to the account shopping.

Baby Shower Door Prises

INVENTORY SHEET

equity Equation:

The equity equation, which actually is not an equation but an equal, since there is no mystery, essential budget equations, and is with the heading Method double, the pillars of the current accounting.

The equity equation is based on the double entry method, which allows a balance to the extent that it is due, and is in the equity equation which understands the importance and essence of the double entry .

In principle, the equation indicates that the active equity equals wealth, but when the liability arises equation becomes assets = liabilities + equity.

The equation has three variables or elements that are explained below:

Active. The assets and rights of the company

Liabilities. The company's debts with third parties. The debts of the company with partners

equity Equation:

The equity equation, which actually is not an equation but an equal, since there is no mystery, essential budget equations, and is with the heading Method double, the pillars of the current accounting.

The equity equation is based on the double entry method, which allows a balance to the extent that it is due, and is in the equity equation which understands the importance and essence of the double entry .

In principle, the equation indicates that the active equity equals wealth, but when the liability arises equation becomes assets = liabilities + equity.

The equation has three variables or elements that are explained below:

Active. The assets and rights of the company

Liabilities. The company's debts with third parties. The debts of the company with partners

Sterilize With Mouthwash Blood Blister

basis of accounting equation

accounting basics Item 1

ARTICLE 37. Consequently, the practitioner should consider and study the user of their services as a separate economic entity that is, relate to the particular circumstances of their activity, be they internal or external to, in each case, the techniques and methods most appropriate for the type of economic entity and the kind of work that has been entrusted, observing in all cases the following basic principles Professional ethics: Integrity

. Objectivity. Independence. Responsibility. Confidentiality. Observations of regulatory requirements. Competence and professional development. Dissemination and collaboration. Respect between colleagues. Ethical conduct. The explanation of the basic principles of professional ethics is the following Integrity

The practitioner must maintain their integrity intact, whatever the field their performance in practice. As a result, it is expected honesty, integrity, honesty, dignity and sincerity in all circumstances.

Within this principle are covered by other related concepts that, without requiring explicit mention or regulation can have a relationship with performance standards established. Such concepts could be the moral conscience, loyalty at various levels, veracity as a reflection of an undeniable reality, justice and equity to support the positive law.

Objectivity Objectivity is above all impartiality and act if harm in all matters that relate to the field of professional action Public Accountant. This is especially important when trying to certify an opinion or comment on the financial statements of any entity. This quality is generally associated with the principles of integrity and independence and is often commented upon in conjunction with this. 37.3

independencies professional practice, the practitioner must have and demonstrate independence of mind and absolute discretion with respect to any interest which may be incompatible with the principles of integrity and objectivity, with respect to which the independence, the peculiar characteristics of accounting profession should be considered essential concomitant. Disclaimer

While recognizing that responsibility as a principle of professional ethics, is implicit in every one of the rules of ethics and rules of conduct of a public accountant, is appropriate and justified specifically mentioned as a principle for all levels of accounting activity. Privacy

Ethics The CPA's relationship with users is the key element of professional practice. For full success of this relationship must be founded on a commitment to responsible, loyal and genuine, which imposes the strictest confidence training. Competition and professional development

The practitioner should only hire work for which he or his partner or partners have skills and expertise necessary to perform services is engaged in an effective and successful .. Dissemination and collaboration

The practitioner is required to contribute according to their personal potential, development, improvement and upgrading of the profession, both institutionally and in any other fields, such as broadcast or teaching will be, affordable. Respect between colleagues

The practitioner must keep in mind that sincerity, good faith and loyalty to their colleagues are basic conditions for free and fair exercise of the profession and for peaceful coexistence, friendly and cordial of its members.

Ethical Conduct

The practitioner must refrain from any action which might adversely affect the reputation or affect in any way discredit the profession, taking into account that the social function involving the exercise of their profession, is obliged to hold his public and private conduct to the highest moral precepts of universal.ARTICULO 38. The CPA is an associate justice in cases specified by law, specifically designated as an expert for it. Also in this condition, the practitioner will do its duty to have the highest view of their profession, the importance of the task entrusted to society as an expert and search for truth in a totally objetiva.ARTICULO 39. The practitioner is entitled to receive remuneration for their work and the people that run under his supervision and responsibility. Such compensation is the normal means of subsistence and compensation for staff to servicio.ARTICULO 40. The ethical principles governing the professional conduct of CPAs do not differ substantially from those governing other members of society. It distinguishes itself by the social implications mentioned above.

PARAGRAPH. This law covers all standing rules of ethics must adhere to the Chartered Accountants registered with the Board Central Institute of Accountants in the exercise of the functions of the Public Accounts established by the laws and regulations.

Item 2

accounts The account is the central data structure in the accounting and payment service. It is the basic of accounting, refers to the duly amended or numbered name given to securities held by the company. The bill facilitates the recording of accounting transactions in the books, represents property and rights and obligations which a company has on a particular date.

Debit refers to money and property is the customer who has an account change bank, as opposed to credit, where money is used dadoEl debit accounts is one of the two features of any application to the books (credit being the other. A rate is reflected in the debit accounts and are active nature of accounting and must always be accompanied by a credit reflected in the "having" can be either in person or in equity. There are two types of accounting in the accounts natures, nature accounts for payment (all those going on the debit side ) and the nature of creditor accounts (all those who are in credit). Refer to the accounts "T".

The word credit comes from the Latin creditum (substantivation the verb credere: believe), which means "trusting thing." That "credit" originally meant among other things, to trust or have confianza.El credit in general is changing a present for future wealth, based on trust and reliability deudor.El granting the credit, some economists is a kind of change that acts in time rather than acting in space. Can be defined as "the change of current wealth for future wealth." Thus, if a miller sells 100 sacks of wheat to a baker, 90 day terms, means he is confident that the arrival date of that period the debt will be canceled, in which case we say that the debt has been "to credit term. "

Double entry

The double entry system is the method or system for recording transactions in the accounts most widely used.

The origin of the double-entry bookkeeping fifteenth century in Italy, where the Franciscan friar Luca Pacioli, who wrote the first treatise on accounting.

Its main tenet is "There is no creditor debtor or creditor without a debtor." This means that, considering all the assets of the company, if an element is reduced because another rises, or, in other words, if an entry in an element is because there is an output of another item, therefore, to debit an account (or accounts) is always having to make a credit in another (or others).

Following this double entry system in each transaction that a company must always seek a double change in the assets of the same.

The bookkeeping is done by scoring two times the amount of the transaction: to debit an account and having the other.

ACCOUNTING SYSTEM REGISTRY.

Accounting for stock purchases and sales: General Accounting

The plan provides for different classes of stock. To see how it works we will look at the bill of goods (300), typical of commercial enterprises. The company should open as many accounts of goods as goods intended for sale. The goods account recorded only the opening and closing stocks of them. Be paid for the initial stock changes under the bill of goods stock (610) and charged by the closing stock credited to the account variation in stocks of goods.

buy merchandise Account (600) should be reflected in the total value of purchases (including transport, insurance, taxes and customs ....) Discounts, rebates or trade discounts except for prompt-payment including invoice consider buying a smaller amount.

The account purchase returns and the like (608) recorded in the remittances have returned to providers for breach of the terms of the order and discounts or similar bill after the defects of quality, delivery failure or other similar things. Rappels

purchases (609). Be reflected in the discount or derived by aboriginal women have a certain volume of orders.

Account of goods sold (700) have collected in the total value of sales excluding the costs to be accounted for in other accounts. Discounts, rebates or discounts including invoice except for early-payment become smaller amount of purchase.

The account sales returns and similar operations (708) must register with the remittances sent back by customers for breach Order conditions and discounts or similar bill after the defects of quality, delivery failure or other similar things, will also be recorded on the debit of this account. Rappels

sales (709). Reflected in the discount or similar should be granted to customers, who have reached a certain volume of orders.

Account 624, transport, other transport harvested from sales on behalf of the company.

discounts on purchases for prompt-payment is considered interest income (765).

sales discounts for prompt-payment is considered a financial expense (665). The packaging account (326-7) functions as the goods account. The purchases are recorded in the purchase of other supplies (602) as well as other stocks in the subgroup (32). The accounts are recorded in the income distribution of containers and packaging (704). If these containers and packages are received or delivered with the right of return recorded in the accounts and packaging for return customers (436) and packaging for return proveedores.Las towards future deliveries or purchases are recorded in the imprest account providers (407) and the customer received the account customer advances (437). 708-9 accounts function as expense accounts. The annotations are produced on the credit accounts and vice versa 608-9.

accounts 6-710 are the only groups that support 6.7 debit and credit entries. So the balance may correspond with your group or not.

Item 3 iva ... ..

TAX AND TRADE AND INDUSTRY AGREEMENT NOTICES AND BOARDS 031 24 DECEMBER 2004 FACT

GENERATOR: The event's Tax and Trade and Industry Notices and board consists of the exercise or performance directly or indirectly in any trade, business or services in the municipality of Ibague, whether that activity is met in a regular or occasional, in particular property, with the establishment or not.

ASSETS SUBJECT: It is an active subject of the Tax and Trade and Industry Notices and board is the city of Ibague.

Debtor: This is subject tax liability of a natural person, legal or de facto partnership that made the event for the tax liability.

CLAUSE: They are also liable to tax on industry and trade and sign and billboard, mixed companies and commercial and industrial enterprises of the State, consortia and joint ventures as partners individually, pension trusts and the provision of services technical, supervision and consulting company in fact exercised by or legal.

ACTIVITIES NOT SUBJECT: Pursuant to Article 39 of Act 14 de1983, are not subject to taxes of Industry, Trade and notices and Boards, the following activities:

The primary agricultural production, livestock and poultry, not to include the manufacture of foodstuffs or any industry where there is an elementary transformation process it is.

National production of goods destined for export.

exploitation of quarries and mines other than salt, emeralds and precious metals when royalties or shares for the municipality is equal to or higher than that correspond paid as Tax of Industry, Trade and sign and billboard.

public education, charities, cultural and sporting, the activities of trade unions, professional associations and nonprofit trade associations, political parties and the services provided by hospitals affiliated or linked to the national health.

When such entities are engaged in or carrying out industrial or commercial activities are subject to the Tax of Industry and Commerce, and board notices regarding such activities.

TAX DEADLINE AND SUBMISSION OF INDUSTRY AND COMMERCE, sign and billboard. The declaration of Industry and Commerce should filed with the authorized banks in the People's Bank Industry, West, Bogotá, Megabanco, Santander, and AVVillas Davivienda. the city of Ibague, since the first of January to the last working day of March each year. And the only Reteica Declaration must be presented at the Banco Popular de la Calle 14 (within 10 calendar days to two months caused).

TAXABLE BASE AND SETTLEMENT: Taxes on Industry, trade and sign and billboard, for each year, will be settled based on the average monthly gross income (ordinary and extraordinary) during the period, in the exercise of the activity or taxable activities by natural or legal persons or companies. PARAGRAPH

-.: The monthly average is calculated by dividing the amount of gross income earned during the previous year by the number of months of activity. The withholding tax will be settled based on the purchase or value of the service billed by the retainer, for each payment made including advances in case they are made.